Property tax rate hikes approved by Kauaʻi County Council

The Kauaʻi County Council made a final vote to approve increases to property tax rates during a county council meeting earlier this week, following public testimony in opposition and debate among council members.

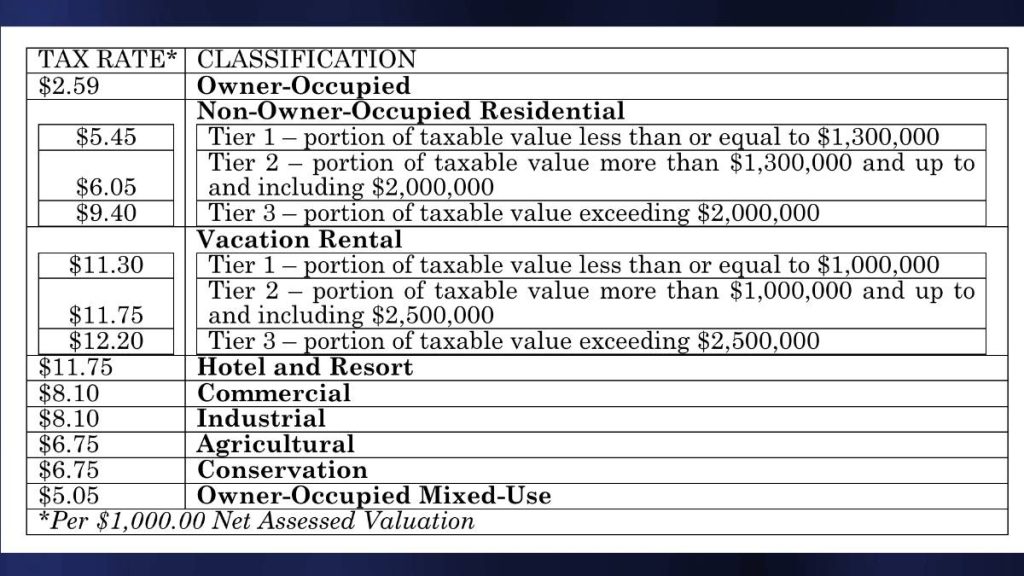

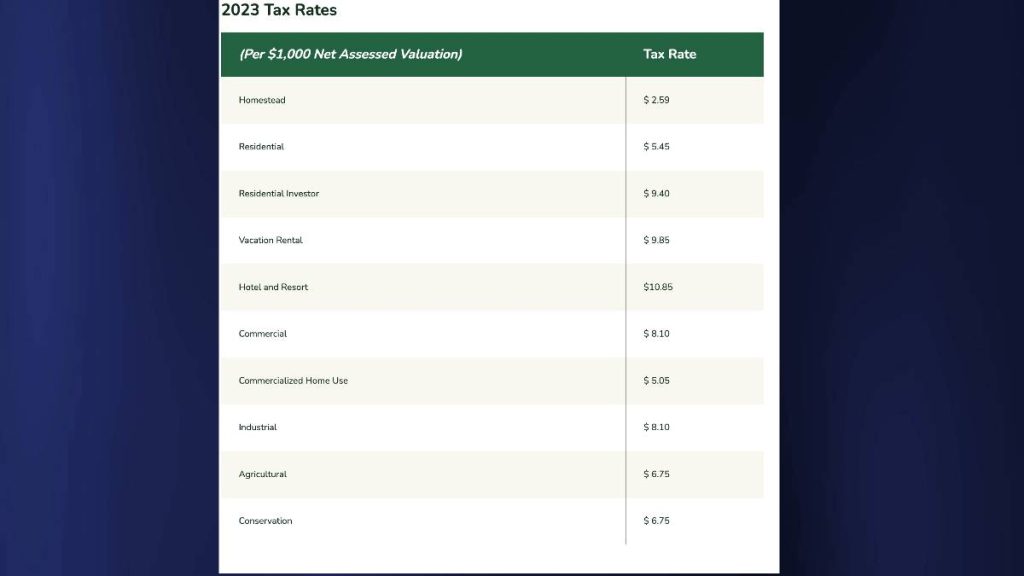

Resolution No. 2024-31 proposes to create a tiered system for real property tax rates for the 2024 to 2025 fiscal year, where more expensive properties are placed into a higher tax rate. The implementation of tiers is an effort to distribute the burden of real property taxes equitably across the county to have taxation rates align with property values.

Speaking at the meeting on Wednesday, council members in support of the increase said the tiered tax system will generate more revenue for the county, which will be used to increase investments in housing developments.

Real Property Tax collections are estimated to provide $234.7 million in revenue to the county for fiscal year 2024-2025, and the county budget has placed $15.7 million of that revenue toward the Housing Development Fund to be used for the county’s housing projects around the island.

With the increase, the total investment in the fund has been estimated to increase to $20.3 million for the upcoming fiscal year, compared to roughly $5 million in the fiscal year 2023-2024.

Council Member KipuKai Kualiʻi stated that the council has known that the Housing Development Fund has needed more funding for years.

“Nobody wants to raise taxes, especially not in an election year. But basically, it’s increasing our investment in housing from 2% of our real property tax to about 5.7% — from 5 million to a total of 20 million,” said Kualiʻi, who emphasized that the funds would go directly to the Housing Development Fund.

Under the new tiered system, rates for non-owner occupied residential properties, as well as all vacation rentals, hotels, and resorts, will be subject to increased rates. The owner-occupied rate will remain unchanged.

Before council members discussed the resolution, several people owning rental properties on Kaua’i provided testimony against the tax increases, saying that the plan would make it harder for them to turn a profit.

“We want to build the economy. But when you start taxing, that nightly rate becomes very competitive. It drops. It hurts everybody,” said one woman who claimed that over half of the monthly rent she collects on her 375-square-foot unit goes to taxes, insurance, and other property maintenance.

Another property owner, who lives on the mainland, was one of several others to complain about the high cost of maintaining a rental unit on Kaua‘i.

“All I do is pay. That’s it. To keep people going, to keep the economy going,” the woman said. “People on the coast that have these little slices of paradise. We make it affordable for tourists to come.”

However, Council Member Addison Bulosan found it challenging to accept testimony calling the tax increases aimed at owners renting out their units “predatory,” describing how it will be used to address housing issues stemming from the impacts of these types of properties on the local housing market.

Bulosan, who is the youngest council member at roughly age 37, said he has always wanted to be like those who can purchase a second property and rent it out to turn a profit.

“I wish I could buy a property, but that’s not feasible for me or my generation,” he said.

“That American Dream that is shared with us to buy one house and live in another to make a profit and create passive income so that you can retire … So that you can keep having a prosperous life and create generational wealth. That dream is not a dream that is close to me,” he said.

Buloson continued, “So the dream that you guys talk about and you guys sharing this burden of really managing your profits … It’s really hard for me to understand. ‘Cause I still live with my parents.”

“I can’t comprehend owning three other properties and being worried about a 2%, 3% increase,” he added.

While most council members saw the increases as necessary for addressing housing issues, Council Members Felicia Cowden and Ross Kagawa expressed concerns about potential negative impacts on the housing market and the local economy.

Cowden’s opposition stemmed from her worries about the possibility of “parking money,” alleging the additional tax revenues would not immediately be invested into the community. She also said the increase would likely cause property owners to sell and lead to a decline in state and county revenues.

Additionally, Cowden raised the issue of industry evasion, saying property owners might attempt to exploit loopholes to avoid taxes.

“I think we’re going to have a cascade of sales. We’re going to see a softening of the market, which could also bring down all our real property taxes if these things start to fall,” Cowden said.

“So I feel like we’re being … penny-wise and pound-foolish in this. We are making lots of mistakes.”

Kagawa was also against the increases, citing similar concerns, including potential negative impacts on tourism, small businesses, and families.

“If you have returning customers, and you keep raising the rate every year on them because of rising costs, you know, they’re gonna find other options, whether it be in Hawai‘i or other islands,” Kagawa said.

He later said the increasing costs could cause people who make a living cleaning, maintaining yards, and working on rental properties to go out of business. “If this economy goes down like this … You’re talking about increasing homeless problems,” he said.

Council Member Billy DeCosta, who proposed the tax increase on the visitor industry, later claimed to speak for cleaners, maintenance workers, and other employees who did not attend to testify themselves.

“I want you to listen to me, please. That’s the kind of leader I am. You listen to me,” DeCosta said.

He noted that the people who came in to testify on the resolution were able to do so because of passive income made through their rental properties.

“But how about other people that cannot come today to testify because they’re busy working? And they’re gonna work tonight,” said DeCosta, describing shift workers who clean rental and vacation properties.

“Do you think they can afford to buy a house at $1.3, $1.6 million?”

DeCosta described himself as a solution-based politician, saying the increase had been introduced as an economic decision following multiple discussions behind closed doors with other county staff.

He emphasized being an advocate for lower and middle-income class groups who were not present at the meeting.

“I beg you when you go home today and look at your profit margin on your four units, or six units, or even two units. Look at who we helped,” he said to the testifiers.

“We’re doing it so the next generation can have a fighting chance.”

The resolution passed in a 4-2 vote with DeCosta, Bulosan, Kualiʻi, and Council Chair Mel Rapozo voting to approve. Cowden and Kagawa voted against it, and Council Member Bernard Carvalho was excused.

In a message response following the meeting, Cowden continued to state her beliefs against the tax increase. “We all want to create the desperately needed housing for our people,” she wrote.

“My concern is we will likely create job loss and increased rent for employees by further stressing their employers as well as the high tax rate for non-owner occupants.”