Deprecated: stripslashes(): Passing null to parameter #1 ($string) of type string is deprecated in /mnt/efs/html/wp-content/plugins/template-scripts/src/AuthorBios/Frontend.php on line 129

‘Not Good News’: Hawai‘i Inflation Will be the Highest in Decades, and Everything Will be Affected

Your $100 won’t be worth as much this year as it was last year.

And that’s pretty much across the board, no matter what you buy.

In fact, according to the Hawai‘i Department of Business, Economic Development and Tourism, that $100 will be about $6 less.

That means, using groceries as an example, if you stock your wagon full of the same hundred bucks worth of food in 2022 as you did in 2021, because of inflation, you’ll only get $94 worth of goods this year.

That’s what inflation looks like: Less for more. And inflation, Hawai‘i’s economic experts agree, is here for the entire calendar year.

“It will be real,” said Eugene Tian, the research and statistics officer for the State of Hawaiʻi. “What that means is people’s purchasing power will be declining. So, with the same amount of money, they won’t be able to buy the same quantity of merchandise as last year.”

How bad will inflation be in Hawai‘i, a state-dependent on shipping?

The short answer is it will be the worst the state has seen in the last two-plus decades, experts said. The 4.8% projection is conservative by some estimates, but still double what it was last year, which was 2.4%

But there are some trends the economy is experiencing that will soften the direct impact to the Aloha State. Also, on a bigger scale, Hawai‘i should fare better than the rest of the United States, which has experienced an inflation mark of roughly 8% so far in 2022 and is projected to remain around 6.2%.

Tian’s office, known as DBEDT, is the one calculating the 4.8%. The forecast is in line with projections of other economic experts, including the University of Hawai‘i Economic Research Organization, or UHERO, which pegs it even higher at 5.5%.

There’s no immediate way around it, the outlook isn’t rosy. People will get less for more.

“It isn’t good news,” Tian said.

Reasons Behind Inflation – And The War Is Only Small Component

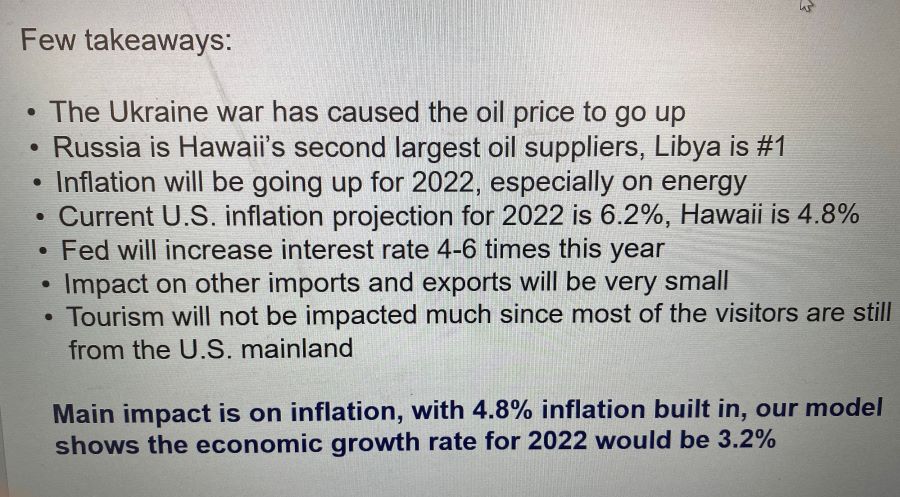

But inflation this year was predictable, experts added. While Russia’s invasion of Ukraine was relatively unexpected, the other factors for the rise weren’t.

There are three main factors for the increase in inflation, and of those three only the war in Ukraine could be viewed as a surprise.

The war is having an impact. Launched on Feb. 24, it prompted a boycott of Russia’s oil in a majority of the world market. UHERO didn’t factor the war into its latest figures, which are based on Honolulu figures, but DBEDT did.

Tian explained that had the military conflict never happened, Hawai‘i’s inflation would have been around 3.8%, still higher than the previous year, but not double. By DBEDT’s forecast, the invasion increased Hawai‘i’s inflation by one percentage point.

The reason that figure isn’t bigger is that Hawai‘i doesn’t actually import that much oil in general compared to the mainland U.S., and not very much, on a grand scale, from Russia.

Last year, Russia was Hawai‘i’s No. 2 ranked foreign oil importer to the islands, sending 6.92 million barrels of crude oil in 2021, good for 27% of foreign oil imports. A sizable figure, Tian pointed out, but well below the No. 1 importer, Libya, who accounts for 68% of the market.

Tian’s figures are also based on the war not lasting the entire year. Nobody can say for certain, but the office’s method is to use the best information possible.

“Nobody expects the war to last past the summer,” he said.

The other two major factors for rising inflation were more easily to predict than the war, and also the reasons Hawai‘i’s inflation would still be higher than last year’s even without the conflict.

They were the result of federal relief money that poured into residents’ pocketbooks during the pandemic and the resulting supply chain shortage that hit businesses across all sectors from the increased demand for goods that the free flow of money created.

Those were predictable because they follow the natural ebb and flow of macroeconomics, Tian explained. When consumers have more money, they spend it. When demand for goods surges and supply chains strain to meet it, prices rise. To control escalating increases, the Federal Reserve increases interest rates, which means it costs more to borrow money, thereby slowing the volume of money lending and, in turn, slowing the demand to spend it. That slows inflation, but also economic growth.

The Fed, meanwhile, is expected to adjust inflation rates four to six more times this year to try and control what’s happening.

The other reason Hawai‘i’s inflation rate is expected to remain below the national average is that Hawai‘i, by comparison, doesn’t import that much merchandise compared to the rest of the U.S., even though its commonly thought of as an import-reliant state. Just on sheer volume of imports, Hawai‘i doesn’t stack up to the continental United States. Nor does the state actually consume that much more petroleum-based products than the rest of the U.S., even though it’s thought of as a severely energy-dependent state sitting in isolation in the middle of the Pacific Ocean.

The total share of Hawai‘i’s expenditures on petroleum is about 5%, whereas the national average is 4%, UHERO’s director explained.

Make No Mistake, Inflation Will Be Felt

That stated, inflation, as Tian pointed out, will be real, and Hawai‘i residents will feel it, especially those on fixed incomes with less wiggle room if they don’t already.

“Where it hits people’s pocketbooks is obviously in gasoline, but even more so in electricity,” Bonham said.

Hawaiian Electric already announced it expects energy bills to increase by 20% for the residents of the Big Island.

But there are other areas residents should keep an eye on, such as those aforementioned groceries. Bonham said he expects grocery prices to increase more so than other areas because of the dependence on oil the agricultural industry requires to produce food.

“In many cases, they’ve gone up more than oil has,” Bonham said.

The numbers say that is true.

The commodity sector has seen the sharpest increases thus far. Commodities are basically merchandise – all the items people tend to buy.

In January, the commodity inflation rate was 10.7% in Hawai‘i and 12.3% on the mainland. In February, the mainland saw it rise to 13%.

So purchasing the same amount of gasoline this year might mean doing without in other areas for some people.

“That means skipping a meal out or cutting back on something that’s not quite a necessity,” Bonham said.

Captain Cook resident Danny Shirley on the Big Island is one of those regular residents who has noticed it already. Retired, Shirley has lived on a fixed income for several years. He does his grocery shopping in Kealakekua and South Kona and has already cut back on “treats” like potato chips, candy bars and other fun snacks he used to add to his and his wife’s grocery cart. Splurge trips to McDonald’s? Forget about it.

Shirley said he braced for the rise in prices as soon as he saw gas prices go up. It already seems to have wiped out the record 5.9% COLA increase Social Security added this year.

“I noticed it but, yet again, I was prepared for it,” Shirley said of what the rising gas prices meant for prices in other sectors. “It seems like they’re 20% higher than they should be.”

Inflation Forecasts Are Just That – Forecasts

UHERO was the office that pegged inflation higher than DBEDT, estimating 5.5%. UHERO’s calculations also didn’t include the Ukraine war, and Bonham said he expects their latest calculations to go even higher.

“Quite frankly, that 5.5 is low,” Bonham said. “It should be closer to 6.5%.”

But there are some silver linings, both experts agreed.

Inflation is rising, yes, but so is everything else, including wages and tourism numbers. Hawai‘i is experiencing pre-pandemic numbers for the first time since 2019. The industry is the state’s economic driver and international tourism is returning this year, as well. An influx of Japanese visitors to add on top of the mainland tourists who have already returned in robust amounts will be a large reason why Hawai‘i is expected to still experience economic growth when 2022 has concluded.

By DBEDT’s projections, the state will see a 3.2% growth rate this year.

Both offices see this as a one-year spike, of sorts, too, what Bonham called a “blip” in the grand scheme of things. UHERO estimates inflation dropping to a 3.3% rate next year, while DBEDT anticipates 2.6%.

Also, they reminded residents that these are projections. Nobody can say for certain what will happen that could impact it, for better or worse.

One figure that the projections did include thus far is what has happened in the housing industry – at least according to the statistics. Perhaps remarkably, Hawai‘i’s numbers say the state hasn’t dramatically impacted rents and housing the way it has already on the mainland.

Hawai‘i, overall, has seen rents increase by 3%, the experts said, a “silver lining of sorts,” Bonham called it.

Yet, real estate and property management professionals on Hawai‘i Island who spoke to Big Island Now said those numbers aren’t reflective of what’s actually happening on the local market.

Several of them told Big Island Now that they’ve never seen rental prices jump more than they ever have just in the last six to 12 months.

Krystal Vartanian Jacobs, property manager for LUVA Real Estate in Kona, and Gretchen Osgood of Hawaiian Isle Real Estate are two in the industry that said the prices are the highest they’ve seen.

Vartanian Jacobs recently rented a three-bedroom place for $3,600 a month while last year it went for $2,400. She wasn’t price gouging, just adjusting rates on a then-vacant home to the current market conditions at the owner’s behest, she said.

The listing didn’t last long on the market, either, she pointed out.

“Out here is absolutely inflating,” she said.

Osgood, too, recently had a similar rental with a similar increase. She also saw a Kona Sea Ridge condo jump $100,000 in price in six months. What she’s seeing, she said, is the “largest jump I’ve ever seen.”

It’s why both are skeptical the state number reflected in the housing industry remains as they are now. So is another property management company in Kona, which declined to go on record, but said they’re experiencing 40% increases in rent prices.

They all attributed it to a lack of supply and, of course, inflation.

“It’s across the board,” Osgood said.

Sponsored Content

Notice: Function the_widget was called incorrectly. Widgets need to be registered using

register_widget(), before they can be displayed. Please see Debugging in WordPress for more information. (This message was added in version 4.9.0.) in /mnt/efs/html/wp-includes/functions.php on line 6114